Walmart sales tax calculator

4 Sales Tax Policy Place details about your sales tax policies and rules in the box provided max 4000 characters. Sales tax is calculated by multiplying the.

Sales Taxes In The United States Wikiwand

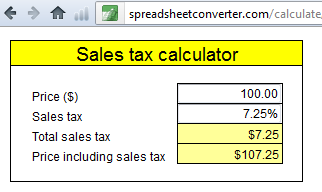

Enter the total amount that you wish to have calculated in order to determine tax on the sale.

. Or to make things even easier input. Sales Tax Calculator Enter your city and zip code below to find the combined sales tax rate for a location. Free sales tax calculator to lookup the sales tax rate and calculate sales tax by address or zip code in the US.

Sales Tax Calculator Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. Businesses impacted by recent California fires may qualify for extensions tax relief and more. Get information about sales tax and how it impacts your existing business processes.

If youd like to calculate sales tax with product exemptions sourcing logic and. To calculate the amount of sales tax to charge in Los Angeles use this simple formula. In Texas prescription medicine and food.

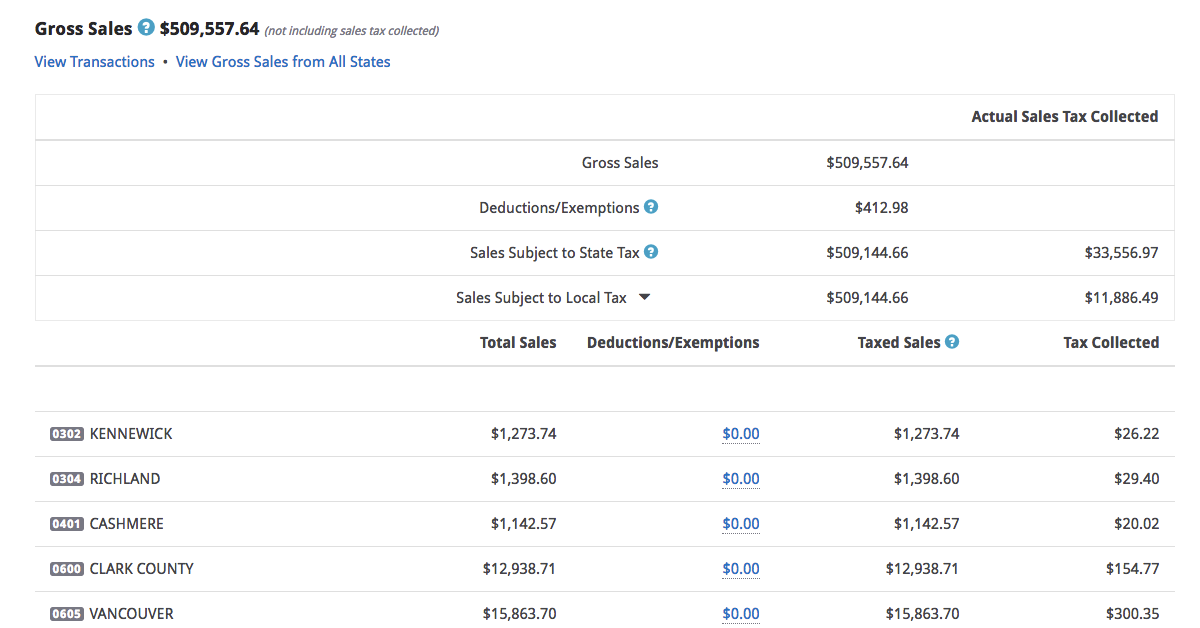

Apply more accurate rates to sales tax returns. How to Calculate Sales Tax Multiply the price of your item or service by the tax rate. Walmart Sales Tax is a really small and easy portion of your onboarding and selling on Walmart experience.

How to Configure Sales Taxes at. Sales tax total amount of sale x sales tax rate in this case 95. Ad Walmart fuel benefit is now at 12000 Exxon Mobil stations more locations.

Log in to the Walmart Seller Center. Sign up for Walmart save 75 a year on gas with member prices now at 14000 stations. In the following sections you can find.

How do you figure out what the sales tax rate is. For instance in Palm Springs California the total. Please visit our State of Emergency Tax Relief page for additional.

The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax. To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal.

Enter the sales tax percentage. Locate the Tax Setup page. Filing and remitting sales tax for your Walmart store has never been easier.

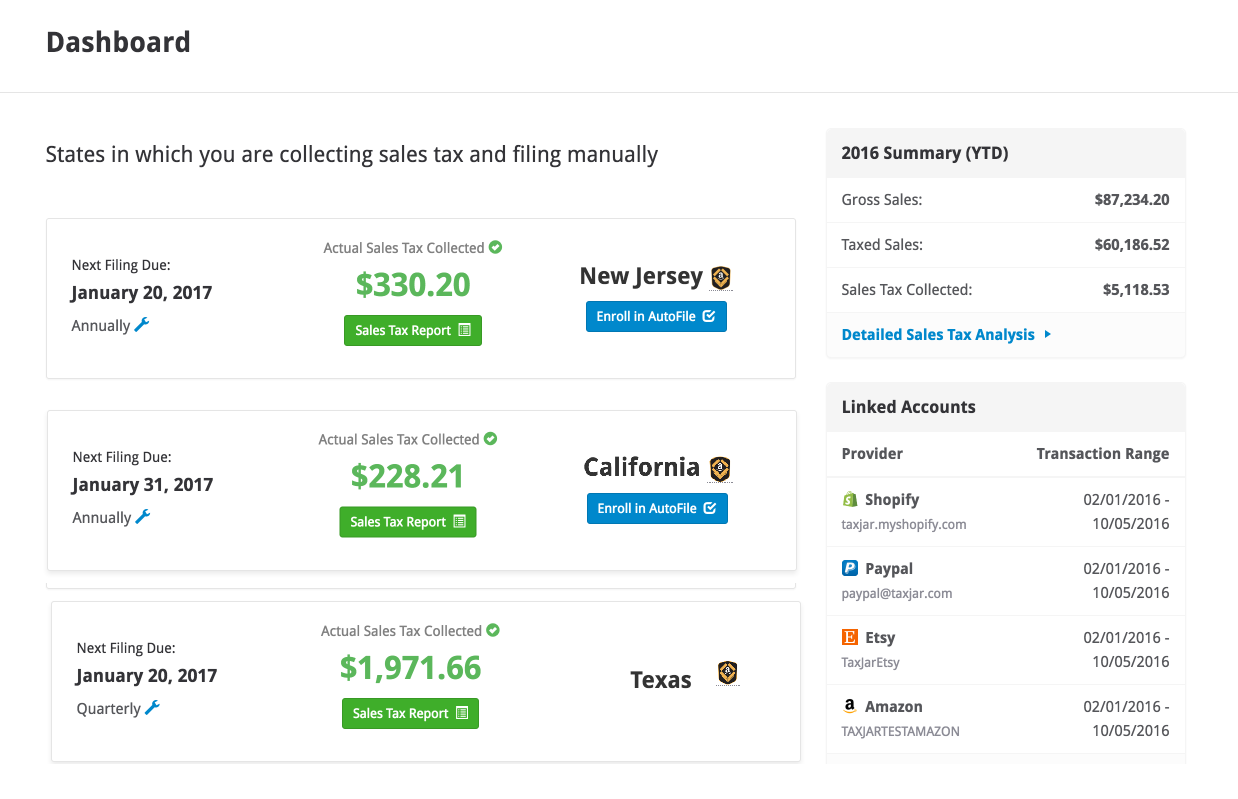

A basic calculator performs the basic calculations. To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax rate. Accuracy guaranteed With economic nexus determination and guaranteed accurate calculations TaxJar ensures you.

Quickly learn licenses that your business needs and.

With Tax Calculator On Sale 59 Off Www Ingeniovirtual Com

You Can Now Simplify Your Walmart Marketplace Sales Tax With Taxjar Taxjar

Configuring Sales Tax At Walmart Com Without Breaking A Sweat

Updated Discount Sales Tax Calculator App For Pc Mac Windows 11 10 8 7 Android Mod Download 2022

Sales Tax On Grocery Items Taxjar

Configuring Sales Tax At Walmart Com Without Breaking A Sweat

You Can Now Simplify Your Walmart Marketplace Sales Tax With Taxjar Taxjar

With Tax Calculator On Sale 59 Off Www Ingeniovirtual Com

Sales Tax Calculator Taxjar

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax

How Does Walmart Calculate Tax Quora

How To Calculate California Sales Tax 11 Steps With Pictures

Walmart Integration Taxjar

How To Calculate California Sales Tax 11 Steps With Pictures

Walmart Integration Taxjar

How To Calculate California Sales Tax 11 Steps With Pictures

How To Charge Your Customers The Correct Sales Tax Rates